Form GST370, also known as the Employee and Partner GST/HST Rebate Application, provides a way for employees and partners to claim a rebate on GST and HST paid for work expenses. This detailed guide will cover everything you need to know to claim this beneficial rebate and put hard-earned money back in your pocket.

What is Form GST370?

Form GST370, officially called the Employee and Partner GST/HST Rebate Application, allows eligible employees and partners to claim a rebate on the GST and HST paid on qualifying work-related expenses.

The purpose of this form is to get a refund on certain GST and HST expenses incurred for your job instead of claiming them only as deductions on your personal tax return. This can help recover some of the sales taxes paid throughout the year.

Form GST370 is for reimbursing GST/HST expenses only. It is not for individuals applying for the regular GST/HST credit, which is a tax-free quarterly payment targeted at low and modest-income Canadians.

Who Can Claim the GST/HST Rebate on Form GST370?

There are two main groups who may be eligible to claim the GST/HST rebate using Form GST370: employees and partners. Let’s look at the specific eligibility criteria for each group.

Employees

To qualify for the GST/HST rebate as an employee, you must meet the following requirements:

- Employment with a GST/HST registered employer: You must have been employed with an employer who was registered for GST/HST purposes and had a business number during the tax year you want to claim the rebate.

- Incurred eligible work expenses: You must have incurred work-related expenses that are considered eligible for the rebate and for which you paid GST/HST. These expenses would be deducted on Form T777 – Statement of Employment Expenses or other applicable forms when filing your personal income taxes.

- The employer is not a listed financial institution: Your employer must not be a financial institution such as a bank, credit union, or insurance company. Employees of these financial institutions are specifically excluded from claiming the GST/HST rebate.

Some examples of roles that may qualify for the employee GST/HST rebate include:

- Office workers

- Sales representatives

- Trade workers

- Drivers

- Construction workers

Partners

If you are a partner in a business partnership, you may also qualify for the GST/HST employee rebate if you meet these criteria:

- Member of a GST/HST registered partnership: The partnership you are a member of must be registered for GST/HST purposes and have a business number.

- The partnership makes taxable supplies: The partnership must provide taxable goods and services, and cannot strictly provide exempt supplies, such as medical services.

- Incurred eligible work expenses: You must have incurred eligible work expenses as a partner for which GST/HST was paid. These expenses get deducted when reporting your share of the partnership’s income on your personal tax return.

Some examples of partners who could claim the rebate include:

- Law firm partners

- Engineering firm partners

- Accounting firm partners

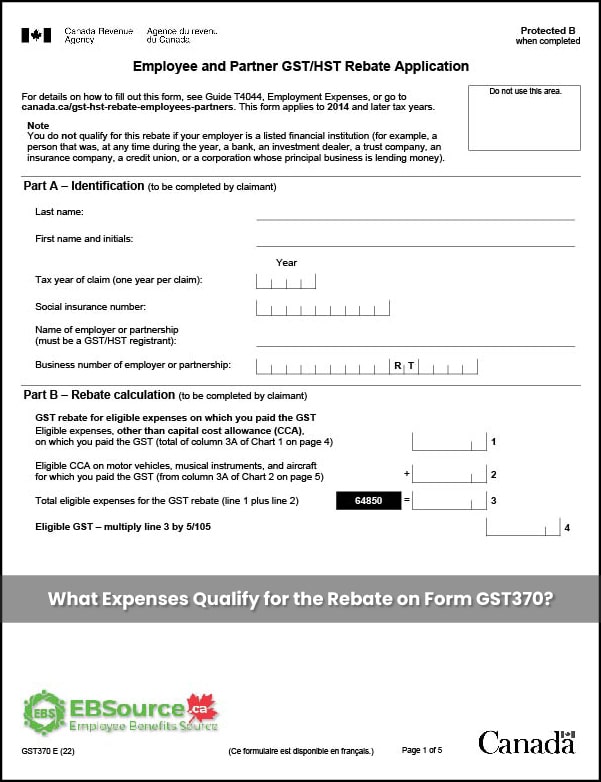

What Expenses Qualify for the Rebate on Form GST370?

Generally, work-related expenses that were subject to GST or HST are eligible for the rebate on Form GST370. Here are key things to keep in mind when determining which expenses qualify:

Employment Expenses

Common employment expenses deducted on Form T777 for employees who qualify for the rebate, such as:

- Vehicle expenses like gas, maintenance, and lease costs

- Travel expenses like accommodation, airfare, and meals

- Office expenses like supplies, software, and stationery

- Educational costs like tuition, professional development courses, conferences

- Meals and entertainment

- Legal and accounting fees

- Promotion and advertising

- Fines and licenses

- Convention expenses

- Salaries paid to assistants

As long as GST/HST was paid on these employee expenses and they are deducted from your T777, you can include them when calculating your Form GST370 rebate.

However, certain employment expenses are specifically excluded, even if they were subject to GST/HST. Ineligible T777 expenses include:

- Salary paid to a substitute: The salary paid to someone filling in for you would not qualify.

- Insurance costs for musical instruments: Insurance for musical instruments owned by an employed musician is excluded.

- Automobile expenses: Vehicle insurance, license fees, and interest paid are all ineligible.

- Work-space-in-the-home expenses: Costs like rent, mortgage interest, property taxes, water bills, and home insurance do not qualify.

So, when going through your T777, exclude any expenses in those categories and focus only on the eligible employment costs.

Self-Employment and Business Expenses

Suppose you are self-employed or a partner in a partnership. In that case, the same categories of expenses are generally eligible if they were deducted from your tax return and included GST/HST.

You would base your claim on expenses deducted on forms like:

- T2125 Statement of Business or Professional Activities

- T776 Statement of Real Estate Rentals

- T2042 Statement of Farming Activities

- T2121 Statement of Fishing Activities

Any expenses related to your self-employed work or partnership duties qualify as long as they are not on the excluded expense list.

Source: GST370: Employee and partner GST/HST rebate application – support.hrblock.ca

Capital Cost Allowance (CCA)

You can also claim the CCA deductions you claimed on your tax return for vehicles, aircraft, and musical instruments, provided GST/HST was paid on them.

For example, if you deducted CCA on a delivery van you use for your business, that amount would qualify to be included in your GST370 rebate calculation.

Ineligible Expenses

Along with the excluded employment categories noted earlier, here is a full list of expenses that do not qualify for the rebate:

- Expenses on which no GST/HST was paid

- Expenses from a non-GST/HST registered employer or partnership

- Expenses that were reimbursed by your employer

- Expenses relating to a non-taxable allowance received

- Personal use portions of any expenses

- 50% of meal and entertainment expenses

- Insurance premiums

- Mortgage interest

- Rent

- Salaries and wages

- Motor vehicle fees and interest

- Legal and accounting fees (unless deducted on your personal return)

You should view this list carefully when determining which expenses to include and which to exclude from your Form GST370 calculation. The key is focusing only on eligible deducted expenses that include GST/HST.

When and How Should I File Form GST370?

You must file Form GST370 annually along with your personal income tax return. Here are some key tips on the filing process:

- Deadline: Form GST370 must be filed by the same due date as your income tax return for that tax year, which is April 30 for most individuals. Late filing could delay your rebate.

- Annual filing: You need to complete and attach a new Form GST370 each tax year based on that year’s expenses.

- File with tax return: Do not mail Form GST370 separately. It must be attached to your T1 personal tax return before submitting it to the CRA.

- Where to enter on T1: Enter the total rebate amount from Form GST370 on Line 45700 of your T1 return.

- CRA mailing address: Mail your T1 return with Form GST370 to the CRA tax centre based on your province of residence. Check the CRA website for the correct mailing address.

- Retain copies: Keep a copy of your completed Form GST370 along with your Notice of Assessment for that tax year in case of review by CRA.

Meeting the tax filing deadline ensures your rebate is processed promptly. Filing on time also prevents delays in assessing your tax return and receiving any tax refund.

What Happens After Filing Form GST370?

Once you have submitted your T1 tax return with Form GST370 attached, here is what you can expect:

CRA Processing

The CRA will receive and begin processing your tax return and rebate application. They may review Form GST370 to verify:

- You have met all eligibility criteria

- The expenses you claimed were eligible

- Your rebate calculation is accurate

The CRA may contact you for clarification or additional supporting documents if required. Having organized records will streamline this process.

Rebate Issued

If the CRA validates your rebate claim, they will issue payment of the amount you claimed on Form GST370. This will be sent to you either by:

- Cheque in the mail

- Direct deposit to your bank account if you signed up for CRA direct deposit

You typically receive your GST/HST rebate within 8-10 weeks after filing if your return is processed on time.

Rebate Becomes Taxable Income

It is important to note that any GST/HST rebate you receive must be reported as taxable income on your tax return the following year.

For example, if you receive a $500 rebate in May 2025 based on your 2024 Form GST370, you must include the $500 as regular income on your 2025 tax return.

CRA Review or Audit

There is a chance the CRA may select your return for further review, particularly if your rebate claim is very high or unusual compared to prior years.

In a review, the CRA may request supporting documents like:

- Form T777 or other proof of expenses deducted

- Receipts showing GST/HST paid

- Employer certification of expenses

If issues or inconsistencies are identified, the CRA may proceed to a full tax audit, where they examine in detail your tax filing, expenses, rebate claim, and supporting records.

Having organized records and retaining original receipts is key to validating your claim during a review or audit. Intentionally making false claims could result in the denial of your rebate and penalties from the CRA.

The bottom line

Claiming the rebate you deserve provides a great opportunity to get back some of the GST and HST you paid out of your own pocket for work. Just remember to retain your receipts, triple-check your expenses, and file Form GST370 on time.

The key is understanding the eligibility criteria, carefully tallying your qualified expenses that include GST/HST, using the proper rebate formulas, meeting filing deadlines, and retaining thorough documentation. Follow our guide here to ensure you successfully claim the GST/HST rebate you are entitled to as an employee or partner.

FAQs about Form GST370

Who has to fill out Form GST370?

Form GST370 must be completed by any individual claiming the GST/HST rebate, either as an eligible employee or a partner in a registered partnership. The claimant is responsible for filling out Parts A, B, and D. For employees claiming expenses relating to a reasonable allowance, the employer also has to complete Part C to certify the allowance was not claimed as an input tax credit.

Do I need to submit receipts with Form GST370?

No, you should not submit receipts or other supporting documents when you file your Form GST370. However, the CRA recommends you retain all original receipts and records for 6 years in case they select your rebate for review and request documentation.

Do I need to sign Form GST370?

No signature is required on Form GST370. You simply need to fully complete Parts A, B, and D as the claimant. If applicable, ensure your employer fills out Part C to certify any expenses relating to allowances received.

How long does it take to get my GST370 rebate?

You generally receive your GST/HST rebate within 8-10 weeks of the CRA receiving and processing your T1 tax return with the completed Form GST370 attached. Filing your return early in tax season helps ensure timely receipt of your rebate.

Can I claim home office expenses?

Unfortunately, home office expenses like rent, mortgage interest, insurance, and utilities do not qualify for the GST/HST rebate, even if you deducted them as employment expenses on your T777.